Returns the price, per $100 face value, of a security that pays

periodic interest.

Namespace:

Imsl.FinanceAssembly: ImslCS (in ImslCS.dll) Version: 6.5.0.0

Syntax

Syntax

| C# |

|---|

public static double Price( DateTime settlement, DateTime maturity, double rate, double yield, double redemption, Bond..::.Frequency frequency, DayCountBasis basis ) |

| Visual Basic (Declaration) |

|---|

Public Shared Function Price ( _ settlement As DateTime, _ maturity As DateTime, _ rate As Double, _ yield As Double, _ redemption As Double, _ frequency As Bond..::.Frequency, _ basis As DayCountBasis _ ) As Double |

| Visual C++ |

|---|

public: static double Price( DateTime settlement, DateTime maturity, double rate, double yield, double redemption, Bond..::.Frequency frequency, DayCountBasis^ basis ) |

Parameters

- settlement

- Type: System..::.DateTime

The DateTime settlement date of the security.

- maturity

- Type: System..::.DateTime

The DateTime maturity date of the security.

- rate

- Type: System..::.Double

A double which specifies the security's annual coupon rate.

- yield

- Type: System..::.Double

A double which specifies the security's annual yield.

- redemption

- Type: System..::.Double

A double which specifies the security's redemption value per $100 face value.

- frequency

- Type: Imsl.Finance..::.Bond..::.Frequency

A int which specifies the number of coupon payments per year (1 for annual, 2 for semiannual, 4 for quarterly).

- basis

- Type: Imsl.Finance..::.DayCountBasis

A DayCountBasis object which contains the type of day count basis to use.

Return Value

A double which specifies the price per $100 face value of a security that pays periodic interest. Remarks

Remarks

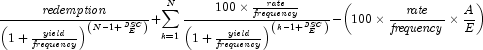

It is computed using the following: