Returns the yield of a security that pays periodic interest.

Namespace:

Imsl.FinanceAssembly: ImslCS (in ImslCS.dll) Version: 6.5.0.0

Syntax

Syntax

| C# |

|---|

public static double Yield( DateTime settlement, DateTime maturity, double rate, double price, double redemption, Bond..::.Frequency frequency, DayCountBasis basis ) |

| Visual Basic (Declaration) |

|---|

Public Shared Function Yield ( _ settlement As DateTime, _ maturity As DateTime, _ rate As Double, _ price As Double, _ redemption As Double, _ frequency As Bond..::.Frequency, _ basis As DayCountBasis _ ) As Double |

| Visual C++ |

|---|

public: static double Yield( DateTime settlement, DateTime maturity, double rate, double price, double redemption, Bond..::.Frequency frequency, DayCountBasis^ basis ) |

Parameters

- settlement

- Type: System..::.DateTime

The DateTime settlement date of the security.

- maturity

- Type: System..::.DateTime

The DateTime maturity date of the security.

- rate

- Type: System..::.Double

A double which specifies the security's annual coupon rate.

- price

- Type: System..::.Double

A double which specifies the security's price per $100 face value.

- redemption

- Type: System..::.Double

A double which specifies the security's redemption value per $100 face value.

- frequency

- Type: Imsl.Finance..::.Bond..::.Frequency

A int which specifies the number of coupon payments per year (1 for annual, 2 for semiannual, 4 for quarterly).

- basis

- Type: Imsl.Finance..::.DayCountBasis

A DayCountBasis object which contains the type of day count basis to use.

Return Value

A double which specifies the yield of a security that pays periodic interest. Remarks

Remarks

If there is one coupon period use the following:

![{{{\left( {{{\it redemption} \over {100}}

+ {{\it rate} \over {\it frequency}}} \right) - \left[ {{{\it price}

\over {100}} + \left( {{A \over E} \times {{\it rate} \over {\it

frequency}}} \right)} \right]} \over {{{\it price} \over {100}} +

\left( {{A \over E} \times {{\it rate} \over {\it frequency}}}

\right)}}} \times {{{{\it frequency} \times E} \over

{\it DSR}}}](eqn/eqn_0288.png)

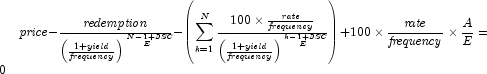

If there is more than one coupon period use the following:

In the equation above, ![]() represents the

number of days in the period from the settlement to the next coupon

date.

represents the

number of days in the period from the settlement to the next coupon

date. ![]() represents the number of days within

the coupon Frequency.

represents the number of days within

the coupon Frequency.![]() represents the number of

coupons payable in the period starting with the settlement date and

ending with the redemption date.

represents the number of

coupons payable in the period starting with the settlement date and

ending with the redemption date. ![]() represents

the number of days in the period starting with the beginning of the

coupon period and ending with the settlement date.

represents

the number of days in the period starting with the beginning of the

coupon period and ending with the settlement date.