ACCR_INT_PER Function (PV-WAVE Advantage)

Evaluates the interest which has accrued on a security that pays interest periodically.

Usage

result = ACCR_INT_PER(issue, first_coupon, settlement, coupon_rate, par_value, frequency, basis)

Input Parameters

issue—The date on which interest starts accruing. For a more detailed discussion on dates see Chapter 8, Working with Date/Time Data in the PV‑WAVE User’s Guide.

first_coupon—First date on which an interest payment is due on the security (e.g. coupon date). For a more detailed discussion on dates see Chapter 8, Working with Date/Time Data in the PV‑WAVE User’s Guide.

settlement—The date on which payment is made to settle a trade. For a more detailed discussion on dates see Chapter 8, Working with Date/Time Data in the PV‑WAVE User’s Guide.

coupon_rate—Annual interest rate set forth on the face of the security; the coupon rate.

par_value—Nominal or face value of the security used to calculate interest payments.

frequency—Frequency of the interest payments. It should be 1, 2, or 4.

1—One payment per year (Annual payment)

2—Two payments per year (Semi-annual payment)

4—Four payments per year (Quarterly payment)

basis—The method for computing the number of days between two dates. It should be 0, 1, 2, 3, or 4.

0—Actual/Actual

1—US (NASD) 30/360

2—Actual/360

3—Actual/365

4—European 30/360

Returned Value

result—The accrued interest for a security that pays periodic interest. If no result can be computed, NaN is returned.

Input Keywords

Double—If present and nonzero, double precision is used.

Discussion

Function ACCR_INT_PER computes the accrued interest for a security that pays periodic interest.

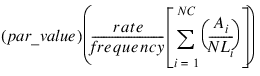

In the equation below, Ai represents the number days which have accrued for the ith quasi-coupon period within the odd period. (The quasi-coupon periods are periods obtained by extending the series of equal payment periods to before or after the actual payment periods.) NC represents the number of quasi-coupon periods within the odd period, rounded to the next highest integer. (The odd period is a period between payments that differs from the usual equally spaced periods at which payments are made.) NLi represents the length of the normal ith quasi-coupon period within the odd period. NLI is expressed in days.

Function ACCR_INT_PER can be found by solving the following:

Example

In this example, ACCR_INT_PER computes the accrued interest for a security that pays periodic interest using the US (NASD) 30/360 day count method. The security has a par value of $1,000, the issue date of October 1, 1999, the settlement date of November 3, 1999, the first coupon date of March 31, 2000, and a coupon rate of 6%.

issue = VAR_TO_DT(1999, 10, 1)

first_coupon = VAR_TO_DT(2000, 3, 31)

settlement = VAR_TO_DT(1999, 11, 3)

rate = .06

par = 1000.

frequency = 2

basis = 1

PRINT, ACCR_INT_PER(issue, first_coupon, settlement, $

rate, par, frequency, basis)

; PV-WAVE prints: 5.33333

Version 2017.0

Copyright © 2017, Rogue Wave Software, Inc. All Rights Reserved.