TBILL_PRICE Function (PV-WAVE Advantage)

Evaluates the price per $100 face value of a Treasury bill.

Usage

result = TBILL_PRICE(settlement, maturity, discount_rate)

Input Parameters

settlement—The date on which payment is made to settle a trade. For a more detailed discussion on dates see Chapter 8, Working with Date/Time Data in the PV‑WAVE User’s Guide.

maturity—The date on which the bond comes due, and principal and accrued interest are paid. For a more detailed discussion on dates see Chapter 8, Working with Date/Time Data in the PV‑WAVE User’s Guide.

discount_rate—The interest rate implied when a security is sold for less than its value at maturity in lieu of interest payments.

Returned Value

result—The price per $100 face value of a Treasury bill. If no result can be computed, NaN is returned.

Input Keywords

Double—If present and nonzero, double precision is used.

Discussion

Function TBILL_PRICE computes the price per $100 face value for a Treasury bill.

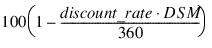

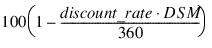

It is computed using the following:

In the equation above, DSM represents the number of days in the period starting with the settlement date and ending with the maturity date (any maturity date that is more than one calendar year after the settlement date is excluded).

Example

In this example, TBILL_PRICE computes the price for a Treasury bill with the settlement date of July 1, 2000, the maturity date of July 1, 2001, and a discount rate of 5% at the issue date.

settlement = VAR_TO_DT(2000, 7, 1)

maturity = VAR_TO_DT(2001, 7, 1)

discount = .05

PRINT, TBILL_PRICE(settlement, maturity, discount)

; PV-WAVE prints: 94.9306

Version 2017.0

Copyright © 2017, Rogue Wave Software, Inc. All Rights Reserved.