DEPRECIATION_DB Function (PV-WAVE Advantage)

Evaluates the depreciation of an asset using the fixed-declining balance method.

Usage

result = DEPRECIATION_DB(cost, salvage, life, period, month)

Input Parameters

cost—Initial value of the asset.

salvage—The value of an asset at the end of its depreciation period.

life—Number of periods over which the asset is being depreciated.

period—Period for which the depreciation is to be computed. period cannot be less than or equal to 0, and cannot be greater than life +1.

month—Number of months in the first year. month cannot be greater than 12 or less than 1.

Returned Value

result—The depreciation of an asset for a specified period using the fixed-declining balance method. If no result can be computed, NaN is returned.

Input Keywords

Double—If present and nonzero, double precision is used.

Discussion

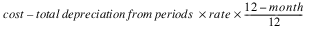

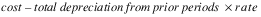

Function DEPRECIATION_DB computes the depreciation of an asset for a specified period using the fixed-declining balance method. Function DEPRECIATION_DB varies depending on the specified value for the argument

period, see

Period Value.

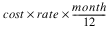

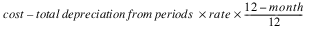

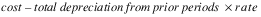

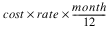

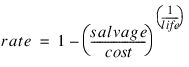

where:

note | rate is rounded to three decimal places. |

Example

In this example, DEPRECIATION_DB computes the depreciation of an asset, which costs $2,500 initially, a useful life of 3 periods and a salvage value of $500, for each period.

ans = FLTARR(4)

life = 3

cost = 2500

salvage = 500

life = 3

month = 6

FOR period=1L, life+1 DO $

ans(period-1) = DEPRECIATION_DB(cost, salvage, life, $

period, month)

PM, ans

; This results in the following output:

; 518.750

; 822.219

; 480.998

; 140.692

Version 2017.0

Copyright © 2017, Rogue Wave Software, Inc. All Rights Reserved.